Australians spent an estimated $1.3 billion on sporting goods over the past year and Rebel Sport currently owns almost a fifth of the sporting equipment market.

This latest retail currency data from Roy Morgan Research spotlights the market ahead of the arrival of French sports retailer Decathlon.

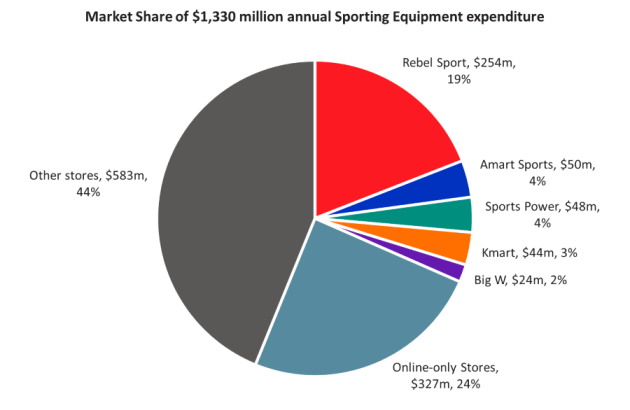

734,000 Australians 14+ (3.7%) bought sporting equipment (not including sportswear and sporting footwear) in an average four weeks in the 12 months to March 2106—spending a combined $1,330 million over the year.

Of the country’s total sporting equipment expenditure, Rebel Sport claimed $254 million (19%)—well ahead of any other individual chain: $50 million was spent at Amart All Sports (which Super Retail Group owns along with Rebel), $48 million at Sports Power, $44 million at Kmart, and $24 million at Big W.

There are also many bricks-and-mortar and online stores that may each hold less than 2% of the overall market, but between them add up to holding 68%--from smaller specialty sports stores such as Sportsco and Stadium Sports, sporting goods stockists like Anaconda, Aldi and Target, and online players like Ebay and DealsDirect.

Roy Morgan Research CEO Michele Levine said the category as a whole is booming.

“Although Australians spent over $1.3 billion on sporting equipment over the past year, we spend far more on sporting apparel, including $2.5 billion on sports shoes and $1.5 billion on sportswear.

“In both these areas, Rebel holds a strong position—although overall not quite as strong as in sporting equipment alone. Our granular consumer research across specific products shows that Rebel’s market position is also stronger among men than women: it holds 21% of the men’s sportswear and 10% of men’s footwear markets, compared with 12% of women’s sportswear and 6% of women’s sports footwear.

“The arrival of Decathlon will no doubt shake the sporting goods and apparel market. It is known a s ‘category killer’, and it’s entering a fragmented market where the current leader holds only around a fifth of market share, and many smaller, independent stores operate.

Roy Morgan’s current and on-going Single Source data includes a bounty of consumer information on consumers’ habits and attitudes to help sports retailers prepare for the new landscape—from product expenditure, satisfaction, and sports participation, to historical data for lessons on how international entrants like Aldi and H&M or local category killers like Bunnings and Dan Murphy’s impacted their respective markets (and competition) across different consumer segments.”